1

Overview

2

Welcome Video

3

Questionaires

4

Guided Tour

Package

Congratulations on taking the first step in having more diligent client conversations. We recommend that you complete this onboarding tutorial before you jump into the Member Section.

If you have any questions, please feel free to email us at support@fppathfinder.com.

Welcome Aboard!

Tell us what you are looking for so we can help enhance your experience as a member

You Need to add some questions for your environment

Go here when logged in as an admin

What is a Planning Topic you address or want to address with your clients every year?

Reviewing Tax Returns

Beneficiary Review

Planning For Strategic Charitable Giving

Which of these describes a current client situation?

I have a new client and I want to show them how much we cover

An existing client needs an annual review

I have a client that is retiring

A client needs their investments reviewed

Which of these most popular resources would you like to view?

Important Numbers (like tax rates)

Master List Of Goals

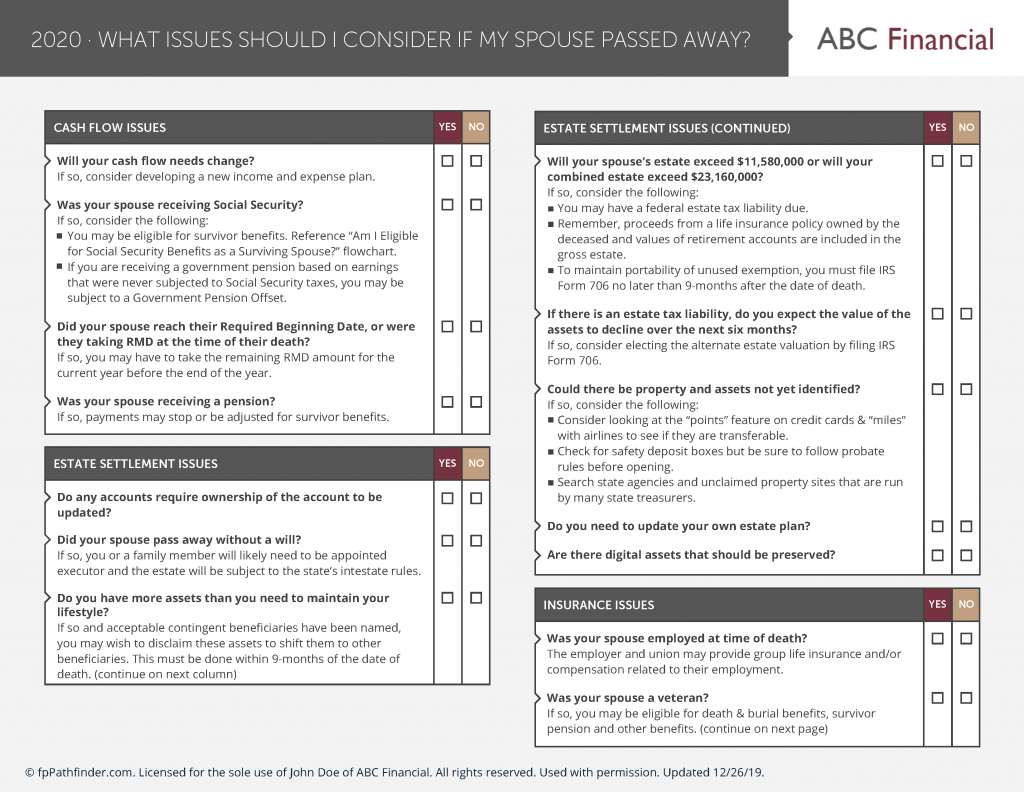

What Issues Should I Consider Before The End Of The Year?

Estate Planning

Tell Us about your Tech Stack. Check All That Apply.

Financial Planning Tools

Holistiplan

Asset Map

MoneyGuide Pro

Right Capital

Moneytree

Income Lab

eMoney

Nitrogen

IncomeConductor

EncorEstate Plans

Trust & Will

Marketing Tools

Snappy Kraken

FMG Suite

Broadridge

CRM

Wealthbox

Redtail/Orion

Salesforce

XLR8

Practifi

EBIX

Microsoft

Advyzon

Scheduling Tools

Calendly

ScheduleOnce

Acuity

What specific benefits or advantages are you seeking to obtain by becoming a member of fpPathfinder?

« Go Back

Skip Step