One way that advisors are using fpPathfinder is to leverage it in conjunction with other tools in their own tech stack. We’ve written about how advisors are using it with financial planning software. But in this post, we wanted to dig into some discussions we have had with advisors that specifically use fpPathinder and Holistiplan.

Much of what is covered below was originally presented in a webinar with Holistiplan. If you’re looking for a summary or recap, here is how advisors are using the two tools together.

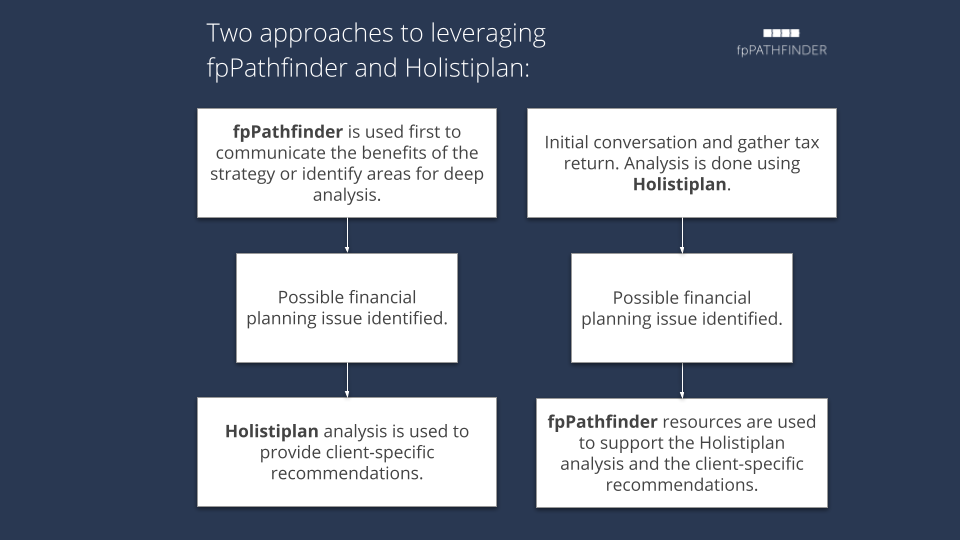

Two approaches to leveraging fpPathfinder and Holistiplan:

Approach one: Lead with fpPathfinder

Some advisors start a conversation with a client (or send a newsletter to clients) and include an fpPathfinder resource – to introduce a planning concept and to help the client understand if the situation may apply to them. If the advisor identifies a possible tax-planning issue, the advisor asks for the tax return and uploads it to Holistiplan where client-specific recommendations could be developed.

As an example, the advisor could write an email, newsletter, or blog post to share with clients that discusses the high-level concept and benefits of doing a Qualified Charitable Distribution. It could outline the benefits, such as reducing tax liability, supporting a charity, and assisting with estate planning. The advisor could end with a call to action such as:

“See the Qualified Charitable Distribution flowchart to consider whether this strategy is right for you. If so, please send us your tax return for further analysis and to receive a specific recommendation.”

Here are the benefits to using this approach:

- The advisor can craft the introduction to tee up the planning concept, focus on the strategy’s high-level benefits, and not waste time trying to tease out the details and the process. The details can be left to the flowchart. The advisor can also inject their professional view and philosophy on the planning opportunity.

- The client can self-select and pre-screen themselves without having to contact the advisor. Perhaps they are interested in doing a QCD and are about to call the advisor. But instead review the flowchart to realize they are unable to pursue the strategy.

After the client reads the letter, reviews the flowchart and sends over the tax return, the advisor can develop a recommendation for the client using Holistiplan. Several advisors employ this exact approach every Fall. It allows them to quickly and efficiently reach out to all of their clients without having qualifying conversations with each person.

Approach two: Lead with Holistiplan

Other advisors will receive the tax return and analyze it through Holistiplan. If a tax planning issue is identified, the advisor can select relevant fpPathfinder resources to share with the client to explain or support the client-specific recommendation.

The following is how one advisor implements this approach:

- The advisor uses Holistiplan to analyze tax returns for each client.

- When the findings suggest the client should consider a Roth conversion to help reduce the overall tax burden, the advisor prepares the package.

- The advisor uses Holistiplan to explain the specific recommendation and the financial benefits of doing the conversion, and the fpPathfinder flowchart that addresses Roth conversion considerations is included to support the recommendation.

- Depending on the client situation, the advisor may share a different resource, such as such as “Will I Avoid IRMAA Surcharges On Medicare Part B and Part D?” , with the client.

- The advisor then shares the report package with the client and uses it to guide the client through the entire conversation. And depending on the situation, the report package may even be shared with the accountant to get their blessing on doing a Roth conversion.

Conclusion

While these two approaches feature two specific planning strategies, there are many other planning issues where you can use fpPathfinder in conjunction with Holistiplan to help guide client conversations. Consider how you can use these two powerful tools when your clients need or want to address 529 plan distributions, IRA and Roth IRA contributions, HSA contributions, NIIT impact, and other planning opportunities.