Debt plays a part in most people’s lives, but many may not know how to start the debt conversation. However, in your role as a trusted advisor, you can help your clients address debt and build better habits for staying out of debt in the first place.

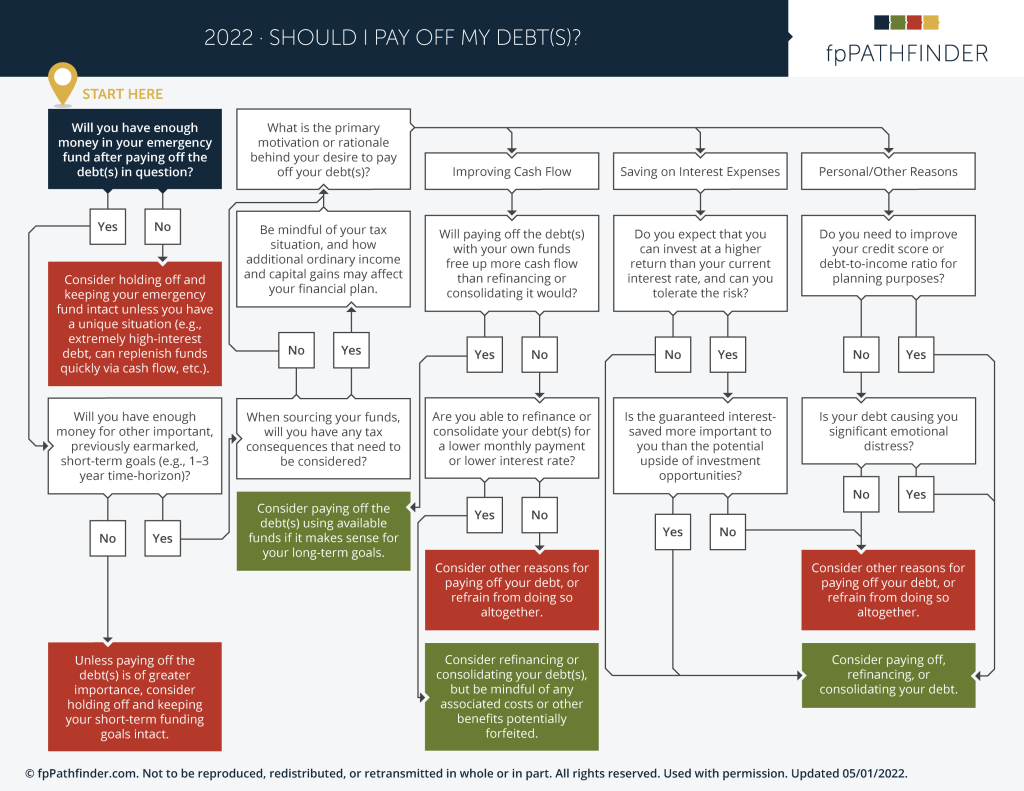

You can start the debt conversation with clients when you introduce the “Should I Pay Off My Debt(s)?” flowchart.

Why Talk About Debt?

People accrue debt in a couple of ways. Perhaps there’s been a hardship, or maybe credit cards have made it easy to increase spending. Regardless of how debt creeps in, it’s a phenomenon that exists at all income levels. When you help your clients address it, even conceptually, you can help bring awareness to the effect it has on their financial lives.

You have the opportunity to:

- Make debt conversations less stressful.

- Assign priority to how to pay off debt.

- Create productive strategies, so clients don’t ignore the debt.

Why Use The Flowchart?

You can rely on the “Should I Pay Off My Debt(s)?” flowchart to provide a sound rationale for paying off debts. Your clients will also gain an appreciation for how much priority they should assign to paying debt relative to other goals. When you have meaningful conversations that address debt, you can take your client relationship far beyond the portfolio. It’s an emotional topic for many, so when you lead your clients through the debt conversation they’ll know you’re willing to address more than just the numbers.

fpPathfinder members can find the “Should I Pay Off My Debt(s)?” flowchart in the member section.

Now is a great time to explore your options if you’re not a member. You can start at the Become A Member page. If you’d like to explore further or engage with our team to have your questions answered in real-time, register for a live demo for a personalized experience.