This guest post was written by Michael Whitman, MBA, CFP®, Owner/Financial Planner for Millennium Planning Group, LLC and was featured on the Kitces Financial Planning Value Summit 2022.

Introduction

When I started in the financial industry back in 2009, I was just happy to get a cubicle, office phone, and a Thinkpad with a signature pad. Boy, has the industry come a long way since then! And I’ve also come a long way since then.

If you take a look at Kitces.com’s Fintech map, you’ll see what looks like 100 or so financial technology companies that have been developed to make our lives (as advisors) easier. The issue that I’ve found is that most advisors do not even fully utilize the Fintech that they have available to them.

In this post, I show you how I conduct a Fintech audit on my practice each year to determine which software I’m using the most, which software I need to to use more, and which software isn’t providing my firm the value we thought it would.

What Is Fintech, And Why Does It Matter?

Fintech, to my firm, is not some flashy software that we use to do Financial Planning for us. We use Fintech software for two main reasons: First, as a way in which we can streamline our back office process to make onboarding or managing our current client experience smoother and more efficient; and second, in order to more easily and efficiently show complex Financial Planning concepts and — most importantly — how they relate to our clients’ financial lives and goals.

How To Integrate Fintech

The best way to start this off is by letting you all know that I am by no means an expert with technology, I cannot write code, and I am limited to what Google can tell me when attacking certain email or website domain tasks. With all that being said, the area where I feel that I succeed within my firm is getting the most out of the technology I’m using. I’ve done this by reading blog posts and listening to various podcasts about what other advisors in the industry have done to make their practices thrive.

Build Your Processes

Process, process, process. I can’t stress this enough — the only way to evaluate the Fintech you use (or plan to use) is to have clear processes for creating financial plans and servicing clients. Once you have a process, then you can add technology to make that process more efficient.

When we created Millennium Planning Group, we didn’t have any processes at first. We knew how to service clients who reached out to us, and we knew how to use the process of our BD to onboard clients. We didn’t know — or even begin to think — that we needed to create our own process to be successful. It’s so important to brainstorm and draft out exactly how you are going to onboard new clients, how you are going to service existing clients, and how you are going to run your practice. The more workflows, processes, and procedures you can put in place, the better your Fintech experience will be.

Decide How Fintech Fits Within Your Goals

Once you draft your process and are mostly happy, you can tweak the process along the way. You can now start to identify the tools you have at your disposal to help you complete the steps within your process. If part of your client service process is to touch base with your clients once a month, how are you going to achieve this? Are you going to send a simple broadcast email from your CRM that you create the content for, or are you going to hire a service to do that for you? Either way you go, this is where you can decide how you want to position your practice to best serve your clients and advisors.

Dive Deeper Into Your Tech Stack

Once you’ve evaluated your existing tools, it’s time to dive deeper into how each one can help you create a more efficient practice.

I use the following tech stack in my practice (we’ll stick to the basic Fintech tools here and leave out the Google drive and Zoom-type tech): Wealthbox CRM, fpPathfinder, Snappy Kraken, Holistiplan, Pulse360, Riskalyze, eMoney, and Asset-Map.

- Wealthbox CRM, Pulse360, and eMoney are the lifeblood of my practice and the main integration tools because of how they interact with the other tools, prepare my meeting agendas and summaries (Pulse360), keep notes organized, and allow me to present complex planning strategies to my clients via eMoney with their Decision Center.

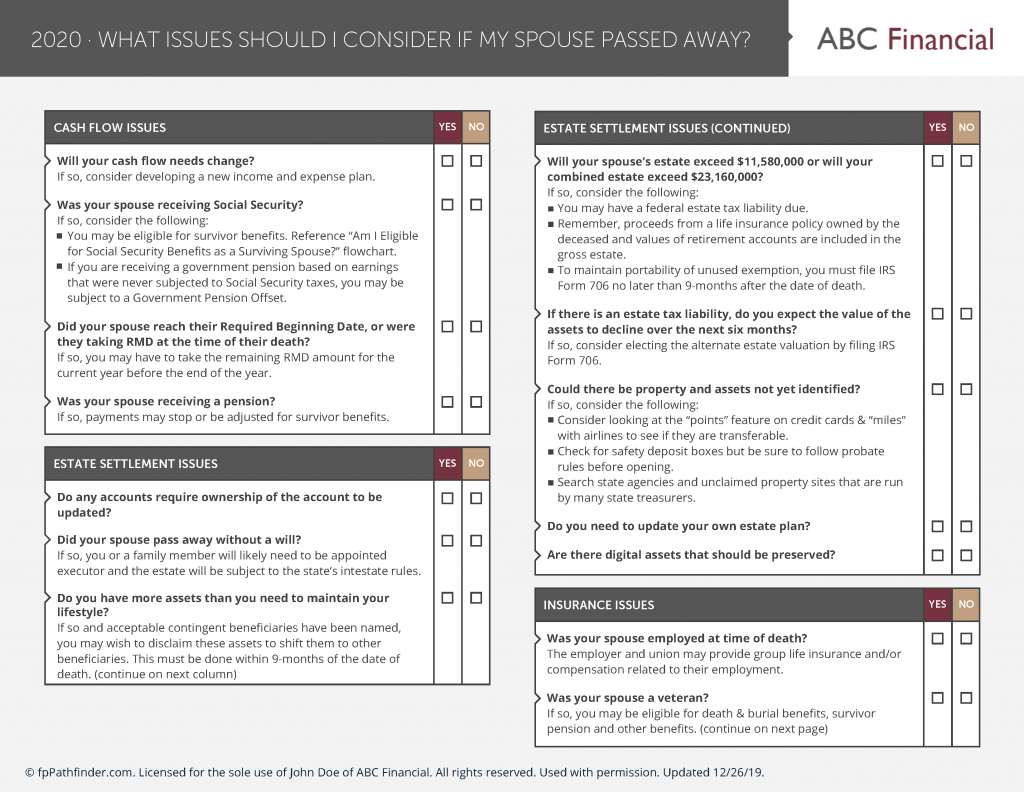

- Snappy Kraken and fpPathfinder deliver valuable content and keep us engaged with our clients on a monthly basis throughout the year.

- Asset-Map helps us ensure that all the data we have collected from our clients is accurate. They just provide the best possible picture to present to clients.

- Holistiplan allows us to add tax planning to our practice and bring up basic and advanced planning concepts using real tax returns and scenarios.

With all the technology that’s out there, it is integral to dive deeper into the capabilities of these tools. Using all the tools mentioned above, I was able to create a more efficient and smoother onboarding process for new clients. There are lots of moving parts, but the clients have a fairly smooth process to engage with us.

Integrations are a key piece for me. I really want the pieces within my tech stack to talk to each other. If I could get all my Fintech to talk to each other I would be the happiest advisor in the world! The key here is to automate and integrate as much as you can, and build easy-to-reproduce manual processes that take very little time to repeat.

Review Your Existing Tech

Just as it’s important to create a process, it’s essential to review the tech tools you have to see if they still fit within your new process. This is a hard one for me; I truly get attached to the technology that I use and develop a strong bond to the relationships I build with their service teams. Sometimes you have to cut out a piece of tech that may have been useful in the past, or that you realize is a nice-to-have but not a necessity. If using the tech is creating more work for you, maybe it is time you find another way and let it go.

Finalize And Test Your Systems

Formally complete the process and the integrations so that they are repeatable — by you and your team. This is super important; in case you’re not available to complete a task yourself, you should be able to easily assign the task to another team member. The most important part about finalizing and then testing your process is to be sure that it is repeatable and efficient, and that it works for you and your practice.

Audit Annually

The last, and most important, part of the process when building and integrating your Fintech is to audit it annually. Every December/January, I sit down and review our tech stack and note where software has shortfalls and where software is providing real value. Sometimes a company has released a new feature that could replace another tool that you have, and sometimes a company becomes more of a hassle to work with throughout the year and needs to be removed or replaced. Whatever the case may be, an annual audit will keep you on your toes and keep your tech stack fresh!

Tips And Reminders For Fintech Integrations

Remember, building a tech stack using the latest and greatest Fintech is a fluid and artistic endeavor. You probably won’t get it right the first time, and it could take years (if ever) to get to a point where you are fully up and running as efficiently as you envisioned. The key that I keep in mind is that my clients don’t know the difference between where I started and where I am now.

Client experience is the key performance indicator for me. If a piece of technology makes the client experience better, it might be worth trying. If a piece of technology is creating issues for the client experience, I immediately add it to the audit list and dive as deep as possible to see if it is user error on my part or if it just doesn’t fit within my firm.

Remember Your “Why”

In conclusion, you do not have to be a computer wizard or a programmer to build an amazing, technology-driven financial planning firm. All you have to do is have a process that you want to achieve to create YOUR ideal client experience, and see what tools are out there to achieve this goal.

As I mentioned above, it took me years to get to the tech stack that makes me feel that my clients are receiving the best client experience I can give them. As long as I keep that as my primary goal, I am 100% sure that my firm will be successful in delivering the value to my clients in the most efficient way possible.

Need Help With Your Tech Stack?

If you are just starting out or have been working in the industry for a while and are having issues building the right tech stack (or utilizing the one you have available to you), help is out there. There are a few big companies that can assist in taking the reins and helping you build a completely customized solution, or you can hire someone like me to assist you in better using your Fintech software to its fullest potential. I’m happy to offer a complimentary 15-minute meeting with you — check out my website here for more information.