Every age-based demographic has its particular planning concerns. The more you can prepare for client meetings, the more you’ll uncover opportunities to help your clients plan.

Life Stages & Planning Needs

Before your meetings, set aside a few minutes to consider your clients’ aged-based planning opportunities.

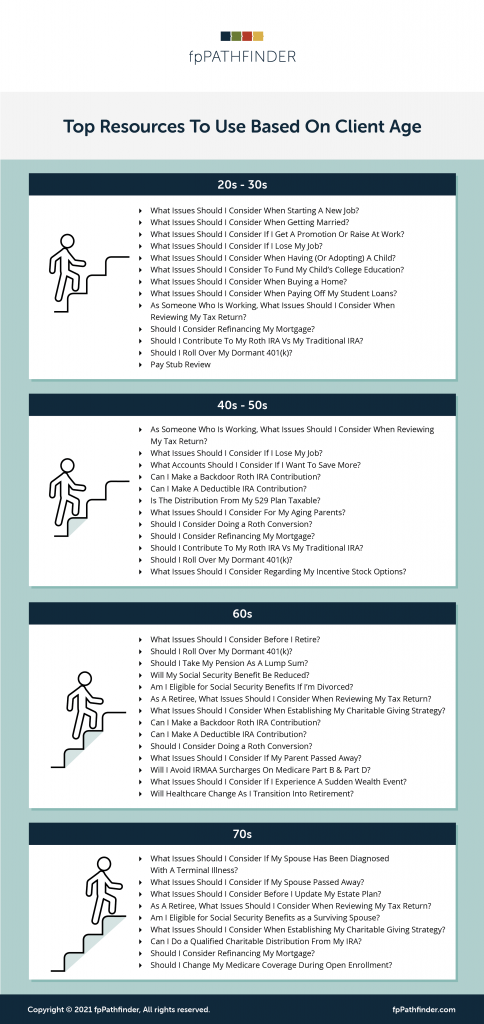

- The 20s – 30s: These clients are just getting started. While they might not have much saved yet, they may be accepting jobs, starting families, and buying property. These are financial decisions that will affect them for years to come, and you can lead the valuable planning conversations early.

- The 40s – 50s: Your clients are in their peak earning years. This is the time, though, when they may be navigating how to save for the future, how to pay for college, and in some cases, how to plan for their aging parents.

- The 60s: Your clients are focused on retirement. There are lots of decisions to consider, including employment transitions, Social Security claiming, healthcare planning, and much more.

- 70s+: Although your clients have made most of the big financial decisions, they still need you. Planning topics like health insurance and estate planning come into focus for your older clients. They will also need your guidance when a spouse or partner becomes ill or passes away.

Checklists & Flowcharts At Your Fingertips

Click on the image below and save the fully linked guide to your desktop as an internal reference to choose relevant checklists and flowcharts. They will help you ask important probing questions and facilitate complex decision-making. You can easily navigate to every checklist and flowchart to:

- Confidently lead conversations about the common financial planning needs related to your clients’ stage of life.

- Constructively respond when unexpected age-related planning issues surface.