You may think systematizing your unique process of financial planning isn’t possible…

But by the end of this post you’ll understand a clear 4-step process for making the work you do with your clients easier, faster, and dare we say it… predictable!

In addition, we’re going to share with you an effortless way to get simple systems setup for your firm today.

But first…

Why should you go through the effort to systematize your financial planning processes when you are already busy as an advisor?

Why Systems Are Crucial to Grow Your Firm

The benefits of a systematized advisory business are endless. And, contrary to belief, processes truly aren’t that hard to set up if you know where to start (we’ll share more on that soon!)

After working with over a thousand advisors to create simple systems in their firms, here are three key reasons every advisor regardless of where they are in their career should be investing in systems and processes:

1. Recreating the process for each client is exhausting, even if you are experienced!

There are clear patterns in providing excellent planning advice. But, what “excellent advice” looks like changes with every client depending on a long list of factors…

-

How old are they?

-

-

-

-

The list of factors may be long and ever changing, but the good news is at fpPathfinder we discovered how to use simple tools to help create a consistency in how you provide advice.

If you want to grow your firm, you can’t spend all your best brain power trying to navigate all the decision points for each client. It’s exhausting! When will you have time to roll out new marketing efforts or take a vacation or work with your other clients?

Simple systems and processes will help you save hours of research and you won’t need to recreate the wheel with every client – even if their factors change.

2. The best way to get new clients is to serve the ones you have now, really well!

It’s no secret, referrals are one of the largest forms of new clients for advisors. But have you ever considered how to create a client who is a RAVING fan so they tell all their friends about you?

Systems and processes create raving fans happen on auto-pilot, not accident.

If you’re waiting until you “have enough time” to delight and surprise your clients, your clients may be waiting a long time!

What if any time a client asked you a question with a complex answer, you could easily walk them through a decision making process that made handling their financial decision easy, clear and accurate?

What if anytime a client had an unexpected life experience like a spouse passing away or a terminal illness diagnoses, you showed up proactively and ready to help them navigate the experience with confidence?

In moments like this, you become more than an advisor… you become a hero in a time of need.

If you can anticipate your clients’ needs before they do, you will build raving fans.

But it won’t happen by accident. You need systems.

3. Financial planning is only getting more complex, not less.

For newer advisors, without systems and processes it can be hard to know how to accurately answer a client’s questions if you have not encountered it before. Sometimes the questions only come up a few times a year. Or the questions come up during a particular time of year (end of year planning)

For seasoned advisors, it can be easy to forget a specific rule or regulation as they change over the years. Just look at what has happened with The Secure Act!

For all advisors, increased compliance and regulation makes our job more difficult! And it will not get easier.

The good news is…

If you’re ready to build a firm that will survive and thrive in a complex and ever-changing financial landscape we are entering, systems and processes are the key!

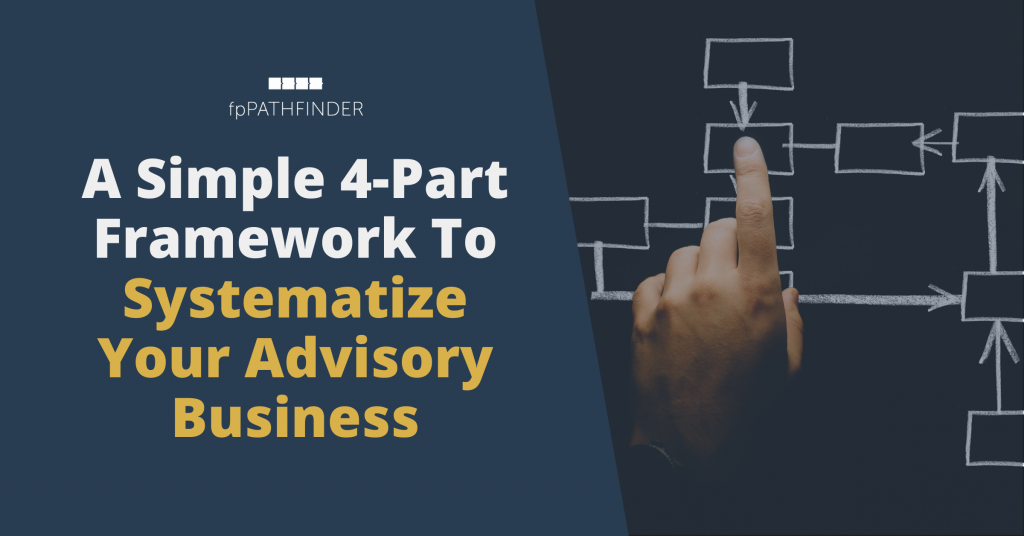

A Simple 4-Part Framework to Systematize Your Advisory

There are lots of benefits to systematizing your firm. If you utilize the simple framework we are about to share you will quickly see where there are gaps in your existing processes.

The Elements Of The Framework:

Part 1: Think of your processes like an “Iceberg”

Every great advisory business is like an iceberg.

When you think about your processes consider there is 20% of the iceberg “above the water” and 80% hiding beneath the surface.

The 20% above the surface represents the client experience and how they interact with you and your firm.

Client experience processes looks like this:

- How the client interacts with your team

- The reports and analysis clients receive from you

- The phone calls and emails clients receive from you.

The other 80% of your firm iceberg is hidden below the water.

That hidden portion represents everything that happens behind the scenes to make the client experience possible, like:

- Administrative processes (opening accounts, processing distribution requests

- Your planning process and creating the financial plans

- Investment management process (account reviews, research, rebalancing)

At fpPathfinder, we recommend you start with the client facing activities that represent the 20% of the iceberg first!

These are the systems and processes that will impact your clients right away and make the biggest impact. The client experience should be at the forefront of any systems developed.

…

RESOURCE: if you need help creating some simple client facing assets, our Deluxe membership will let you brand our checklists and flowcharts so you can share them with your clients.

…

After you address the key “above the water” client facing systems, move on to “below the water” activities.

Make a list of all the steps that must occur behind the scenes in your firm to create an incredible client experience.

Your starting list can be as detailed as needed. Start simple and build more complexity later. It doesn’t need to be perfect out of the gate.

Now that you can see the opportunities for systems client facing (above water) and behind the scenes (below the water), you will be able to identify the gaps you need to fill in your systems and processes.

Part 2: Consider your clients experience

Smart advisors build proactive systems and processes.

A proactive system is one where the advisory firm reaches out to clients to initiate the client experience.

A common example would be an Annual Client Review meeting.

In the case of an annual review meeting, there is an email or phone call from you or your firm to kick-off the process.

An “advisor-initiated” experience can be similar to a client service calendar where each month or quarter there are certain deliverables provided.

However, here is where most advisors drop the ball…

The most effective and efficient advisors know they also need to build reactive processes.

A reactive process is what you do when a client reaches out with a problem, concern, or question.

This happens often when a client needs to change the amount they contribute or distribute. Or in some cases, some clients call you when they are nervous about the markets.

The “reactive” parts of your planning process are also important and for many advisors are often not thought through.

Depending on your business, reactive processes may be on the rare side… but, when they do occur, they can be more important than most of the advisor-initiated client experiences, such as a client annual review.

When a client calls you and shares they just lost their spouse, were just diagnosed with a terminal illness, or lost a job it’s your opportunity as an advisor to know exactly how to react to these kinds of life events and lead your clients with confidence through a challenging time.

Part 3: Go deeper with “areas of focus”

For many advisors, there are areas they go deeper than others.

Depending on the extent you offer investment management, accounting, or insurance, you may find it helpful to create distinct silos of the client experience in addition to what you provide for financial planning to your clients.

For example, if you offer investment management (in addition to financial planning) to your clients, you may want to consider what the experience is like for specifically for investment management.

If you offer a lot of investment support, you may want to consider:

- Investment commentary / insights

- How to respond to concerns that arise during volatile markets

- How you measure and address your client’s risk tolerance

Perhaps you realize your client experience skews more toward investment management and you will need to create additional systems there.

Considering your “areas of focus” will help you identify where you can go deeper with your systems and processes.

Part 4: Continuous Improvement

Systemization in your advisory firm is not a task that will ever be “complete.” Creating effective systems and processes is an on-going effort. And your firm will always be changing and adapting, especially as it grows.

However, as you build out more systems and processes you’ll win back your time and brain power to invest in other systems or goals as an advisor.

Instead of trying to build an entire service calendar all at once… focus on one step at a time. Start with one step of the process and systemize one piece that will make a big impact.

Inevitably, you will need to make changes and refinements too over time.

As you do, consider the different steps of the process here and update your systems.

Simplify Your Financial Planning Process

If you want to get a head start on your systems and processes, consider checking out our membership called fpPathfinder.

We create elegant checklists and flowcharts to help advisors simplify their planning process and run their firms better.

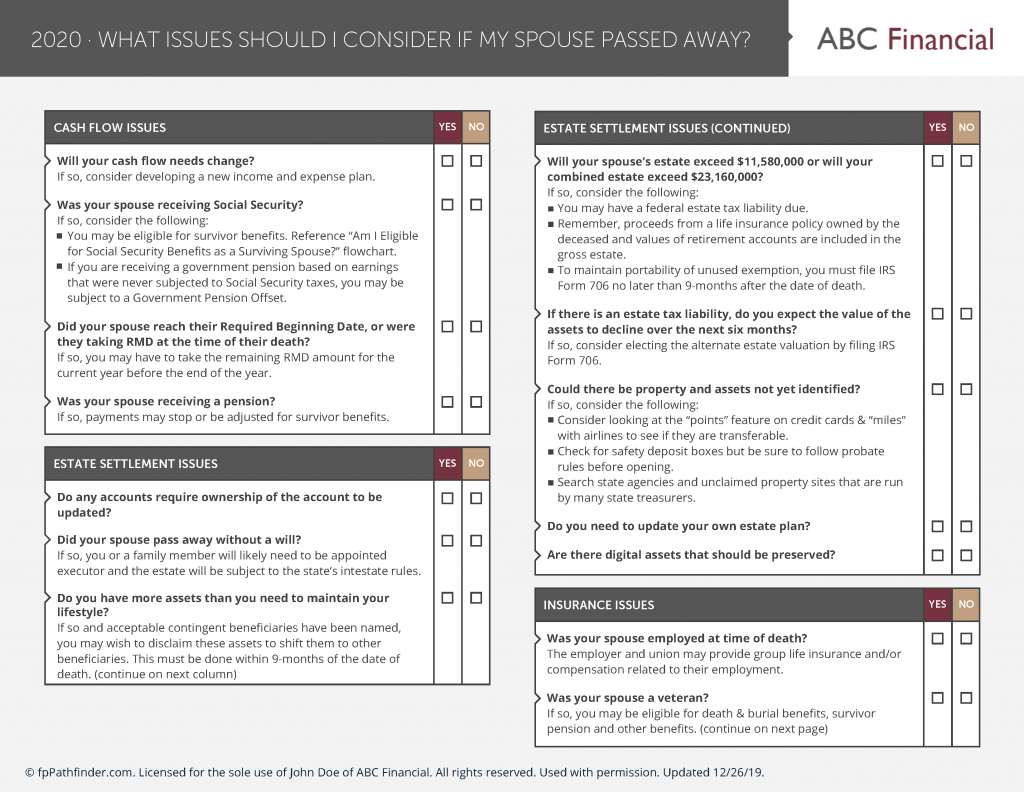

Checklists our members already have access to include:

- Can I Make A Deductible IRA Contribution?

- What Issues Should I Consider For My Aging Parents?

- What Issues Should I Consider If My Spouse Passed Away

- As A Retiree, What Issues Should I Consider When Reviewing My Tax Return?

- As Someone Who Is Working, What Issues Should I Consider When Reviewing My Tax Return?

- Will I Have To Pay Tax On The Sale Of My Investment

- What Issues Should I Consider Before The End Of The Year?

- Issues To Consider In A Client Annual Review Meeting

- Important Numbers Advisors Need to Keep in Mind

Plus, we create two new checklists that are nominated by our own members every month!

Thousands of advisors already use our checklists and flowcharts to help systemize their firms.

Over the coming years, the financial planning landscape will get more complex, not less.

At fpPathfinder, we are here to help you tackle the ever changing rules, regulations and landscape proactively and with ease!

Remember: systemization is a process! Over time and as your systems become more robust, it will open the door to finding ways to automate certain aspects and go deeper in your processes.

Ready to get started systematizing your planning firm? Learn more about fpPathfinder and how we can help!