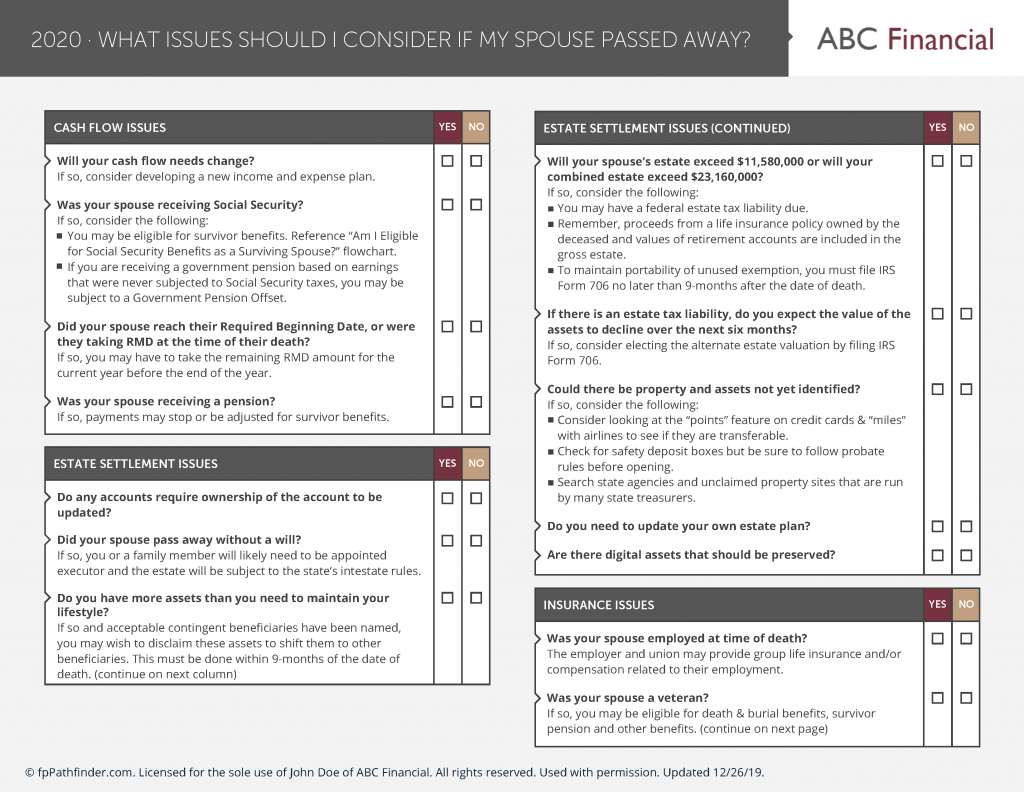

Our purpose at fpPathfinder is to raise planning issues and identify decision points so that financial advisors have a script to guide more productive client conversations. Often members and non-members alike ask how we approach guide development, and what we do to ensure that we are being diligent.

Here is the core process that drives how we operate:

The Process: We follow a seven-stage process, with multiple checkpoints to ensure that guides are accurate, thorough, and remain up-to-date.

- Roadmap Phase – We develop guides based largely on member suggestions, and release them at the most appropriate times of the year. We strive to deliver quality content that members (and their clients) will find timely, important, and valuable, while also rounding out the coverage of topics across our overall offering.

- Kickoff Phase – With a topic identified, we conduct preliminary research, and discuss the scope of the guide. We anticipate the likely focus and flow of the advisor-client conversation to create the guide’s framework.

- Research & Draft Phase – The bulk of our time is spent identifying key planning issues and decision points, conducting research, and drafting the checklists or flowcharts. We consult various reliable sources as we assemble and organize information, and begin to draft our guides.

- Review Phase – We subject our checklists and flowcharts to a series of reviews and edits, conducted by various team members. The guides are evaluated and revised at several levels from different perspectives, and they cycle through stages of independent fact-checking, technical proofreading, and a best-practices, advisor-based critique.

- Design & Finalize Phase – The final draft of each guide is designed and formatted according to our specific standards. The designed guide is then circulated for a final round of fact-checking, and technical proofreading, and review by the team.

- Release Phase – The guide is loaded onto the fpPathfinder website, and the release is announced to members through email, social media, and our blog.

- Revision Phase – Our guides are subject to ongoing review and revision throughout the year. In addition to annual updates, we may revise guides as a result of proactive internal audits, member feedback, new legislation/guidance, etc. In most cases, the guides under revision cycle through stages three through six, above.

The Team:

- We have a small, core team dedicated to creating the guides. Our diverse academic degrees, designations, credentials, and professional experiences combine to create a multifaceted approach to our guides.

- From time to time, we share drafts of the guides with additional outside financial advisors/experts to seek further planning perspectives or technical feedback. It’s important to note that we avoid overly-technical guides, aiming to ensure that our members feel comfortable using our guides, but can still layer in their expertise as they see fit.

- We encourage and welcome member feedback to ensure that our guides identify the important issues and key decisions. As a result, we are able to tap into the collective expertise of our 3,000+ members.

The Sources:

- Our information and figures come primarily from legislation, the IRS, Social Security Administration, Medicare, etc.

- To supplement our information, we will use paid research services, including Thomson Reuters Checkpoint, to verify and get clarity on technical rules.

- We will reference journal publications, reputable blogs, and consumer-focused articles, to ensure that we are covering all the issues and decisions, and to understand how clients may digest the information.